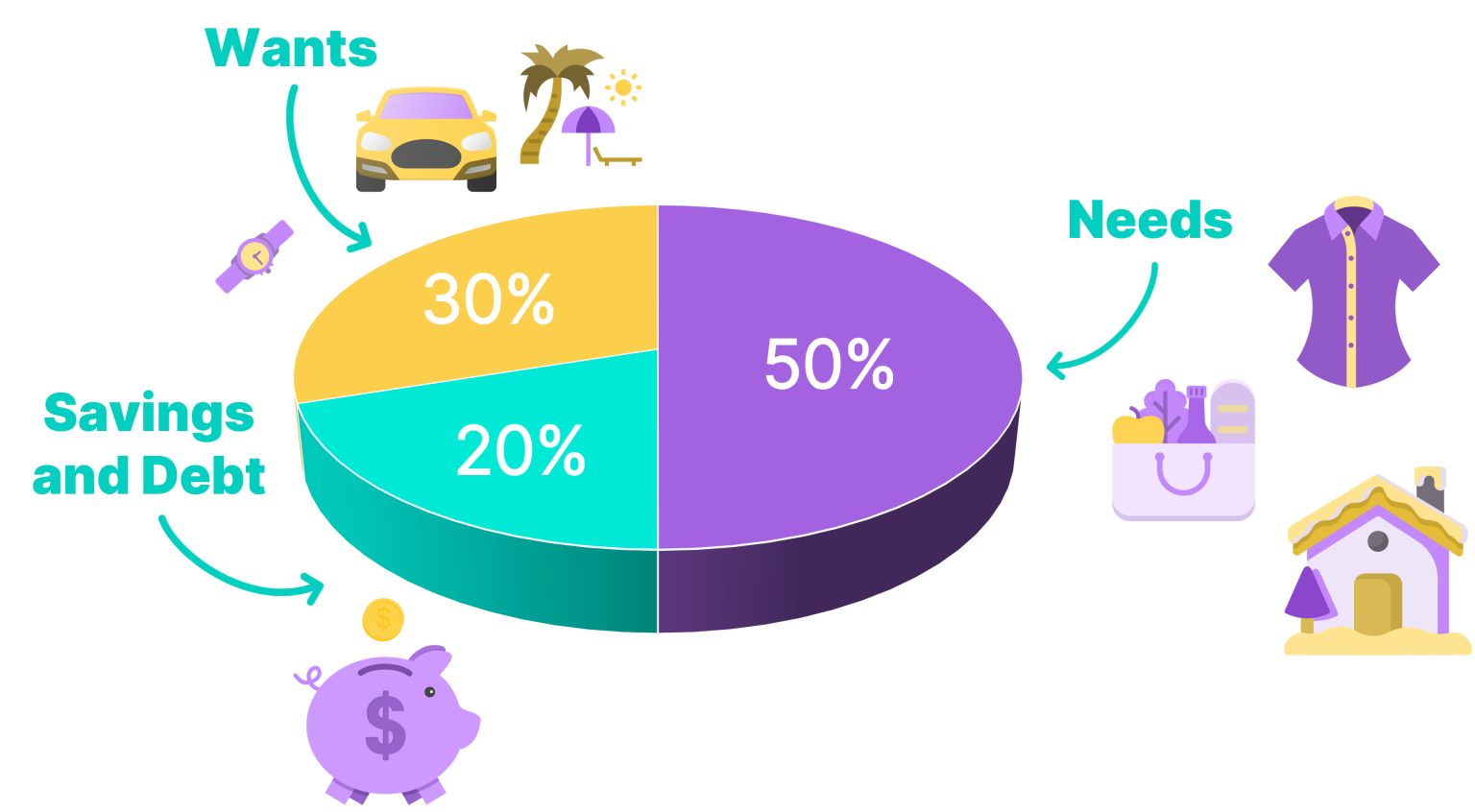

In times of economic uncertainty like a recession, when money feels tight and the future seems uncertain, it’s crucial to manage our finances wisely. 💵 That’s where the “Golden Ratio of Budgeting” comes in.

It’s a simple way to divide up your money into three main parts:

-

Essential Expenses (50%): This part covers things you really can’t do without, like rent or mortgage, groceries, utilities, and transportation to work. These are the most important things you need to pay for. 🏠

-

Discretionary Spending (30%): This part is for the fun stuff—like eating out, streaming services, hobbies, and shopping for things you want but don’t necessarily need. It’s important to enjoy life, but during tough times, keeping this part in check helps you save more. 🏖️

-

Savings and Debt Repayment (20%): This section is for the future. It’s money you set aside for emergencies or to pay off debts faster. Having savings gives you a safety net, so if something unexpected happens, you’re better prepared.💰

Now, you might wonder, “Why use this method during a recession?” Well, when money is scarce and uncertainty looms, having a clear plan for your finances becomes super important. 📉

By following the Golden Ratio, you ensure that you’re covering your essential needs first (50%), not overspending on things you could do without (30%), and still setting aside something for the future (20%). 🔮

This method helps you prioritize what’s most important when every dollar counts. It’s like having a guide to make sure you’re making the most of your money, even when times are tough. 🌈